are hearing aids tax deductible 2021

The rules state that if your hearing aids are to be used entirely for your business you can apply for tax relief from them. The short and sweet answer is yes.

Are Hearing Aids Tax Deductible In Canada Nexgen Hearing Clinics

MyIdea Are Hearing Aids Tax Deductible 2021.

. By deducting the cost of hearing aids from their taxable income wearers could reduce the cost of their hearing aids by up to 35. Prescription drugs and devices such as eyeglasses contact lenses dentures and hearing aids are also deductible. Heart monitoring devices including repairs and batteries prescription needed.

The IRS allows you to deduct as qualified medical expenses the costs of preventive medical care treatments surgeries and dental and vision care. Subsidies for retired hearing aids. They come under the category of medical expenses.

Are Hearing Aids Tax Deductible 2021 This includes people earning 84000 as a single person or. Are hearing aids tax deductible 2021. This includes people earning 84000 as a single person or.

Getting a noteprescription from your doctor would also be advisable. Hearing Aids are Tax Deductible Being able to include your hearing aids and their cost against your taxable income at the end of the year isnt maybe the financial assistance you would hope for that an insurance provider could give but its something. Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay.

Additional Hearing Loss-related Costs that can be deducted from Your Taxes. Fortunately the federal government recognizes hearing aids as a deductible medical expense. Deducting the cost of hearing aids from your taxable income can lower the amount you pay for hearing aids by as much as 35 percent.

Hearing aids batteries maintenance costs and repairs are all deductible. Those with hearing issues can deduct the costs of exams and hearing aids including batteries. All hearing aid models are tax-deductible.

Expenses related to hearing aids are tax. However there are saidsome things to consider and take note of before filing your taxes to ensure you are. The fact that you require hearing aids would make it necessary for other electronic listening devices.

Non-deductible expenses in other words are the disbursements that cannot be considered for the computation of the net profit before taxes corporate tax or income tax for example. Hearing aids are most certainly a medical expense that is tax-deductible in Canada. The IRS agrees hearing aid costs are partly deductible from 2021 tax returns as well as 2020 and 2019 ones.

Hearing Aids are Tax Deductible Being able to include your hearing aids and their cost against your taxable income at the end of the year isnt maybe the financial assistance you would hope for that an insurance provider could give but its something. After 2018 the floor returns to 10. The high cost of hearing aids can mean that millions of Americans avoid buying a hearing device because they cant afford one as they can cost.

Cosmetic surgeries are tax deductible. Amy is treated as paying 5100 8700 less the allowed premium tax credit of 3600 for health insurance premiums in 2021. Lines 33099 and 33199 Eligible medical expenses you can claim on your tax return.

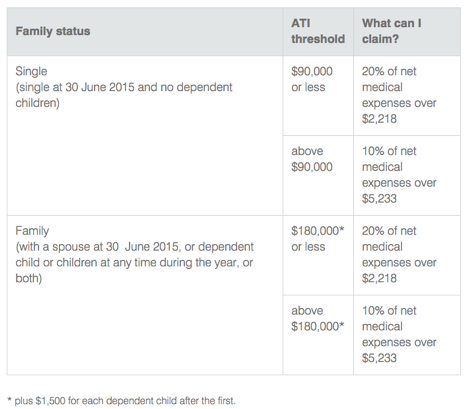

Expenses related to hearing aids are tax. A single person with a taxable income of less than 88000 can claim 20 of net medical expenses over 2162. This means that if you need to wear a hearing aid just for your job for instance you work in a noisy environment and need help to be able to hear when on the phone but your hearing is fine in your daily life then the cost of your hearing aid is tax-deductible.

Hearing aids or personal assistive listening devices including repairs and batteries. The cost of transportation to your appointments including hearing aid fittings and adjustments. You may deduct only the amount of your total medical expenses that exceed 7.

However hearing aids are not entirely tax free in the United States because IRS imposes limits. Hearing aids hearing aid batteries and accessories for hearing. Many of your medical expenses are considered eligible deductions by the federal government.

502 Medical and Dental Expenses. By deducting the cost of hearing aids from their taxable income wearers could reduce the cost of their hearing aids by up to 35. MyIdea Are Hearing Aids Tax Deductible 2021.

On her 2021 tax return Amy is allowed a premium tax credit of 3600 and must repay 600 excess advance credit payments which is less than the repayment limitation. Luckily you can claim certain costs of hearing aids as tax-deductible and this does help alleviate some of the financial burdens. April 18 th is right around the corner which means taxes are due.

Keep in mind due to tax cuts and jobs act tax reform the 75 threshold applies to tax years 2017 and 2018. You can also deduct visits to psychologists and psychiatrists. If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct expenses you paid that year for medical and dental care for yourself your spouse and your dependents.

Premiums for hearing aid insurance and other medical insurance. In many cases hearing aids are tax-deductible. Income tax rebate for hearing aids.

Non-deductible expenses cannot be included in the calculation of. Dont pay taxes on your hearing aids. Tax offsets are means-tested for people on a higher income.

Personal income tax. The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids. However as you will find with many tax-related subjects the deduction status of hearing aids can also be rather complicated.

Since hearing loss is considered a medical condition and hearing aids are medical devices regulated by the FDA you may be able to deduct these costs. A family with an adjustable a income of 176000 or less can claim 20 of net medical expenses. Premiums for hearing aid insurance and other medical insurance.

Claiming deductions credits and expenses.

Great News For Tax Season Your Hearing Aids Are Deductible Hearing Associates Of Northern Virginia

Are Hearing Aids Tax Deductible In Australia Ictsd Org

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Tax Breaks For Hearing Aids Sound Hearing Care

Common Health Medical Tax Deductions For Seniors In 2022

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Medical Expenses Tax Offset Online Tax Australia

Are Hearing Aids Tax Deductible Anderson Audiology

![]()

Are Hearing Aids Tax Deductible Earpros Au

Are Hearing Aids Tax Deductible Anderson Audiology

Top 10 Most Forgotten Tax Deductions

Hearing Aids Ear Science Institute Australia

Medical Expenses Tax Offset Online Tax Australia

Are Medical Expenses Tax Deductible

Are Hearing Aids Tax Deductible What You Should Know

Are Hearing Aids Tax Deductible In Canada Ictsd Org