maine excise tax rate

6 year 0040 mil rate If a town did not collect excise tax then. Cigarettes are also subject to Maine sales tax of approximately 035 per pack.

Cities Need More Flexibility In How They Tax

Spinney Creek Tide Gate Schedule - 2022.

. YEAR 1 0240 mil rate YEAR 2 0175. Town of Eliot 1333 State Road Eliot Maine 03903 207 439-1813. As of August 2014 mil rates are as follows.

The rates drop back on January 1st each year. 2022 -- 2400 per 1000 of value. Mil rate is the rate used to calculate excise tax.

1 City Hall Plaza Ellsworth ME 04605. To calculate your estimated registration. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

Watercraft Excise Tax Requirement. Designed to provide the public with answers to some of the. Maines general sales tax of 55 also applies to the purchase of beer.

2021 -- 1750 per 1000 of value. Welcome to Maine FastFile. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below.

Visit the Maine Revenue Service page for updated mil rates. 2019 -- 1000 per 1000 of value. The maine state sales tax rate is 55 and the average me sales tax after local surtaxes.

DYER LIBRARY SACO MUSEUM. MSRP manufacturers suggested retail price HOW IS THE EXCISE TAX CALCULATED. Share this Page How much will it cost to renew my registration.

Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. These rates apply to the tax bills. Fees Fee includes 100 agent fee 0-10 Horsepower Motor - 3100 with lake and river protection sticker.

Excise Tax is calculated by multiplying the MSRP by the mil rate as shown to the right. 2018 -- 650 per. 1 CNG Hydrogen and Hydrogen CNG tax rate is applied to every 100.

Monday-Friday 8AM to 5PM. In Maine cigarettes are subject to a state excise tax of 200 per pack of 20. 2020 -- 1350 per 1000 of value.

The Maine State Statutes regarding excise tax can be found in Title 36 Section 1482. 2018 -- 650 per 1000 of value. 13 rows Maine Tax Portal.

In Maine beer vendors are responsible for paying a state excise tax of 035 per gallon. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. Maine Beer Tax - 035 gallon.

The rates drop back on january 1st each year. 0-10 Horsepower Motor - 1600 without lake and river protection sticker. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle.

Departments Treasury Motor Vehicles Excise Tax Calculator. This calculator is for the renewal registrations of passenger vehicles only. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes.

Our office is also staffed to administer and oversee the property tax administration in the unorganized territory. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. Calculation will be based on.

Maine Watercraft Excise Tax Law - Title 36. MAINE OFFICE OF TOURISM. Contact 207283-3303 with any questions regarding the excise tax calculator.

Maine Cigarette Tax - 200 pack. Multiply your vehicles msrp by the appropriate mil rate. The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55.

Maine Cigarette Tax - 200 pack. Property Tax Educational Programs. 2022 Maine state sales tax.

How much will it cost to renew my. Exact tax amount may vary for different items. The excise tax due will be 61080.

Watercraft Excise Tax Rate Table. WATERCRAFT EXCISE TAX RATES Commercial Tax 300 300 Tax 300 Tax 350 Tax 500 650 1000 Tax 550 700 1050 Tax 650 800 1150 Tax 750 900 1250 Tax 900 1050 1400 Tax.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

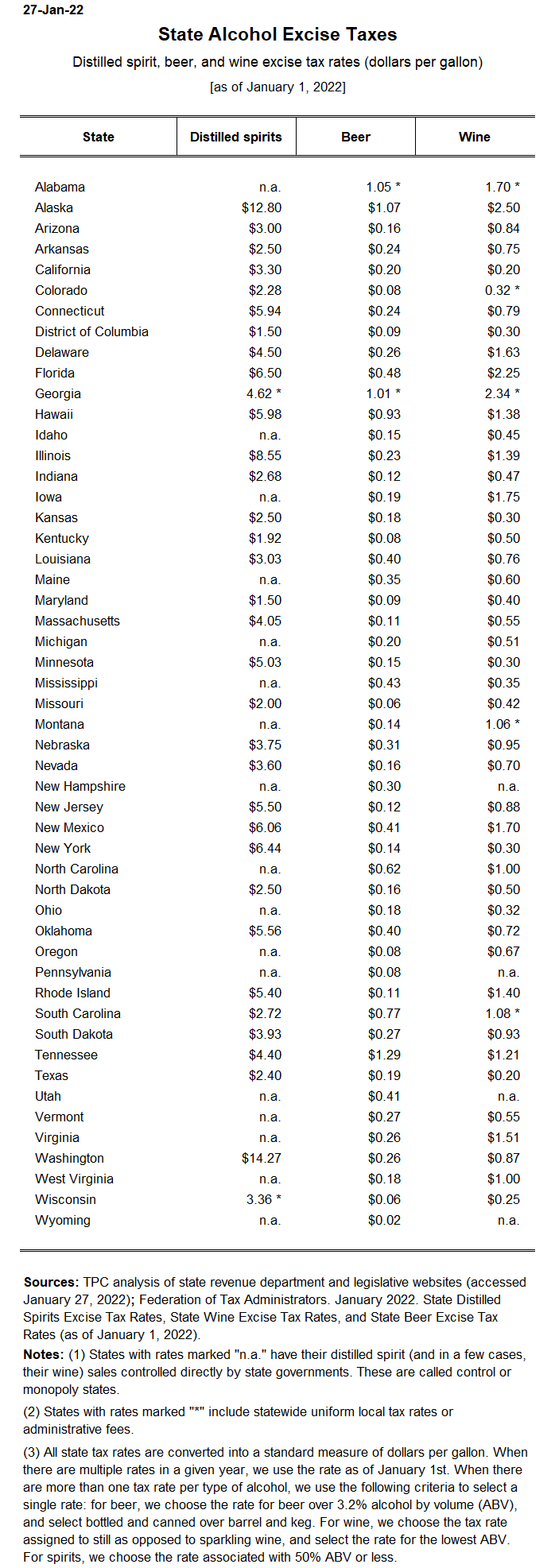

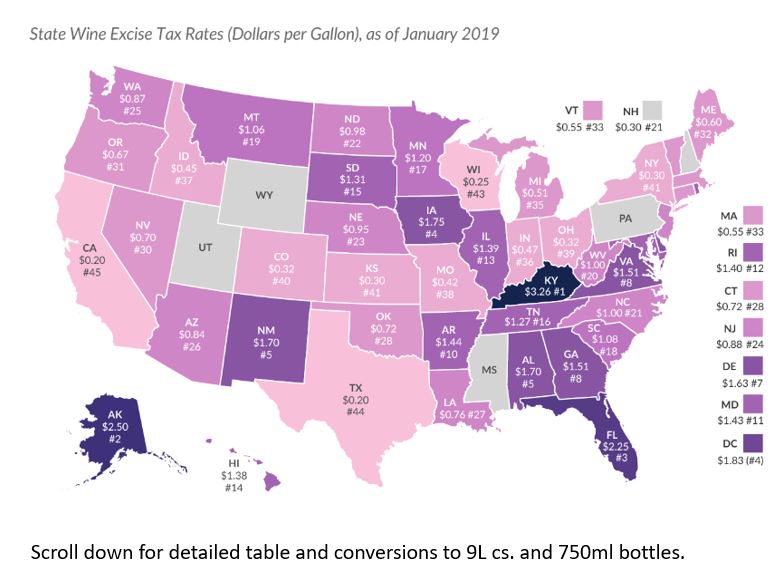

State Alcohol Excise Tax Rates Tax Policy Center

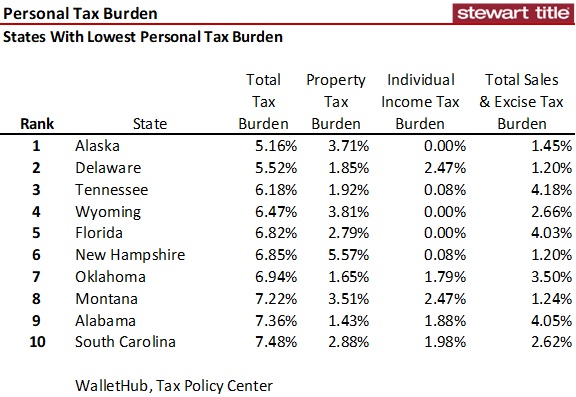

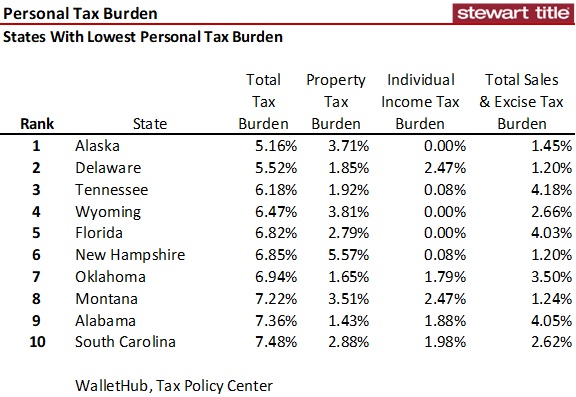

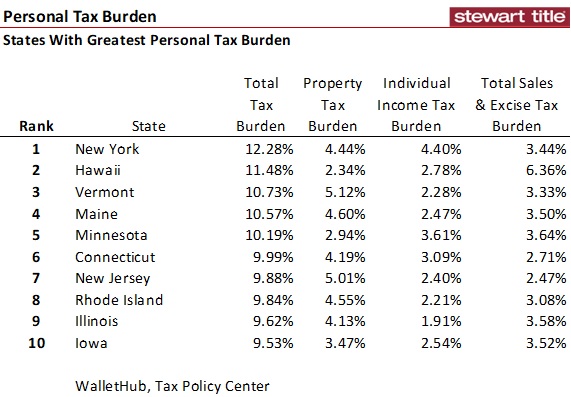

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

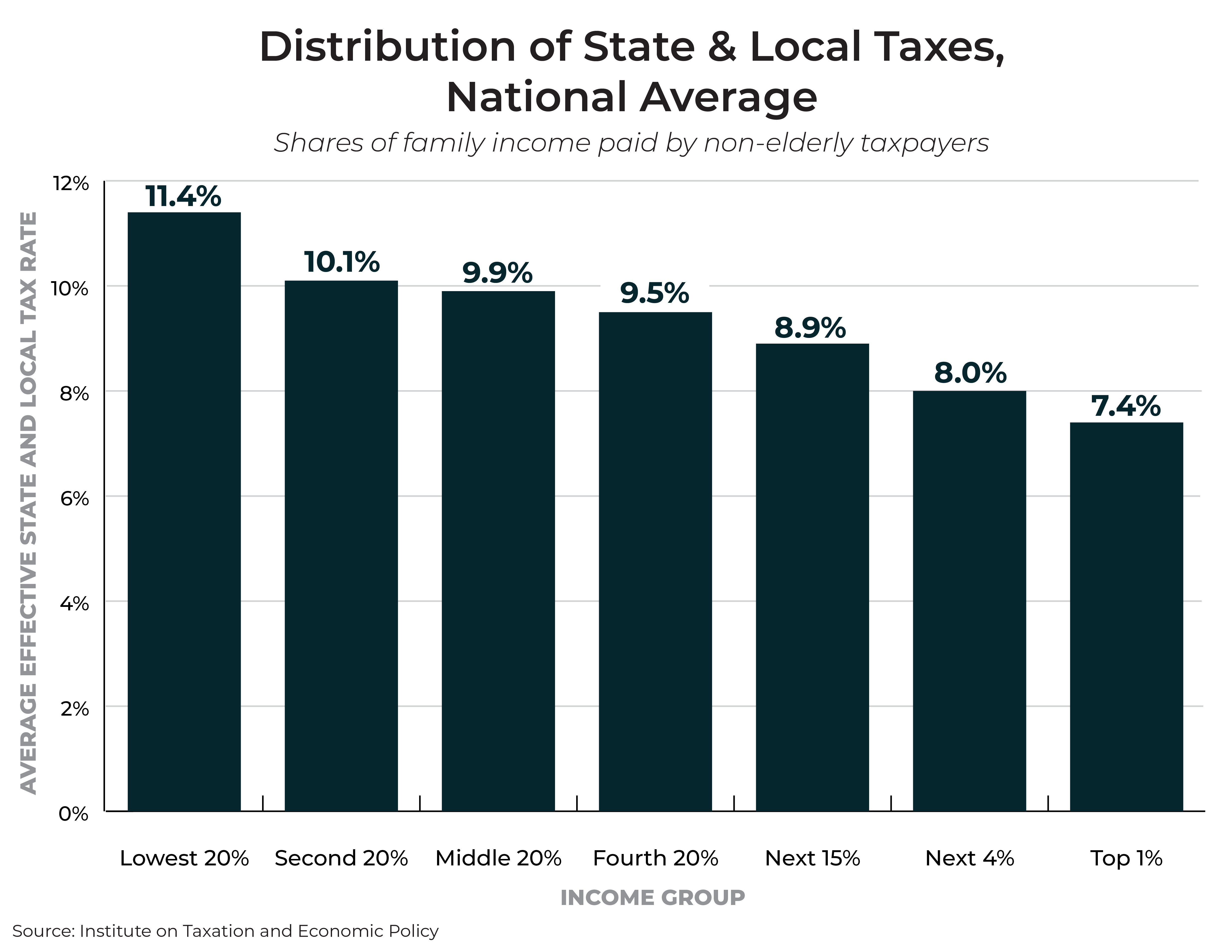

Fairness Matters A Chart Book On Who Pays State And Local Taxes Itep

State Cigarette Excise Tax Rates United States April 2015 Download Scientific Diagram

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Figure 10 State Cigarette Excise Tax Rates By Pack In 201 Flickr

State Wine Excise Taxes Updated Bevology Blog Oh Pinions

Cigarette Excise Taxes In Select States Per Pack Infographic Http On Wsj Com K81nby Infographic The Selection Tax

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

Cigarette Taxes In The United States Wikipedia

The Most Popular Beer Brands In America Map Most Popular Beers Popular Beers Beer Brands

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Upsssc Cane Supervisor Result 2019 Languages Questions Supervisor Merit

Which U S States Charge Property Taxes For Cars Mansion Global